We know we need insurance to cover everything from catastrophic accidents to routine health care. But what do our equine partners need, if anything?

By Sarah E Coleman

Equine insurance options can be quite overwhelming, but can offer horse owners incredible peace of mind. While the most commonly purchased equine insurance policies are mortality and major medical, there are lots of other option.

These two types of insurance are best explained in terms many people may be more familiar with: life insurance and health insurance. Typically mortality insurance (“life insurance”) is paid out if the horse dies. Owners are paid for the full or partial value of the horse. Medical and surgical policies (“health insurance”) can cover the costs associated with treatment of injuries or illnesses.

Mortality Insurance

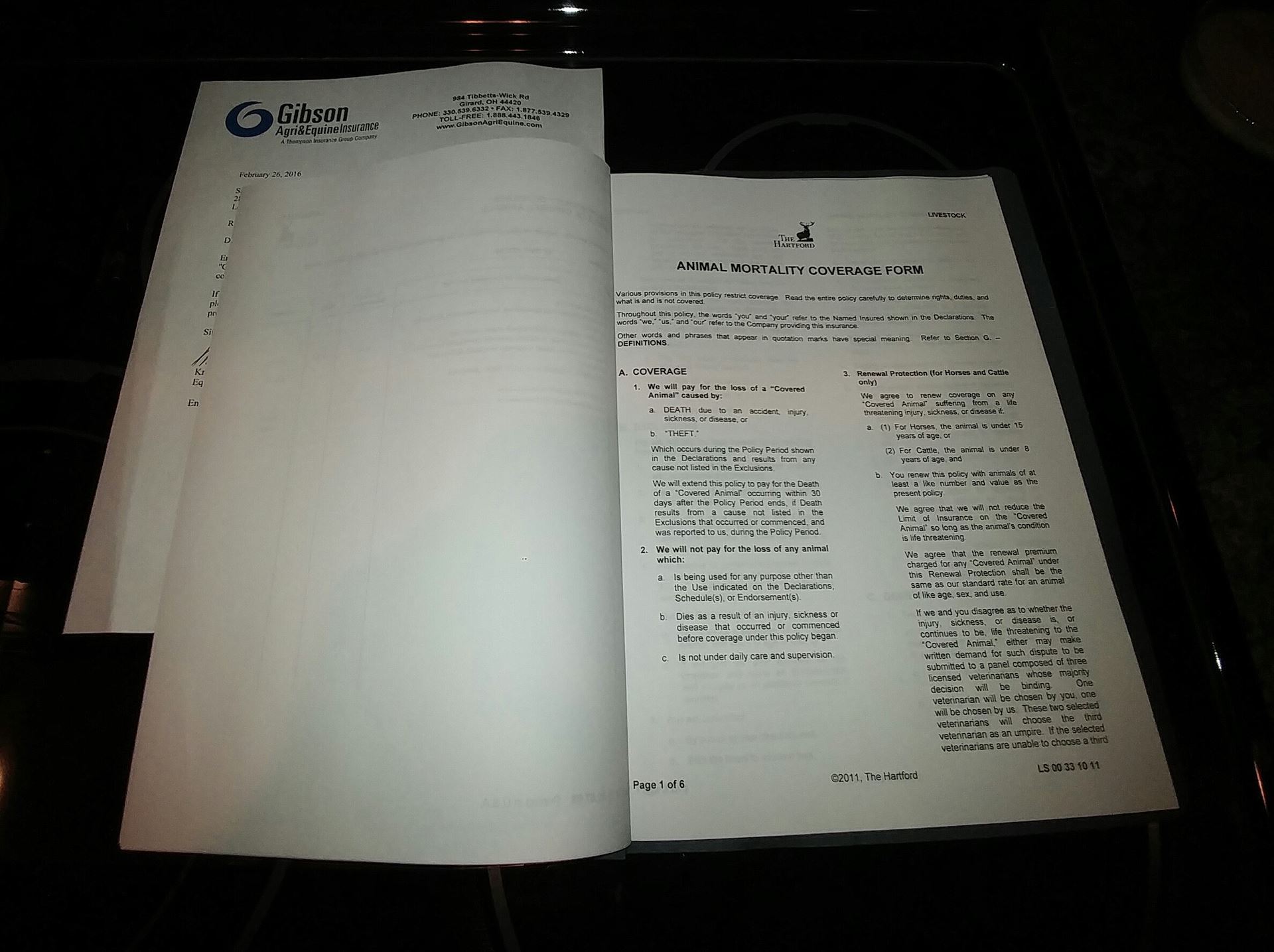

The most popular equine insurance Kristin Detwiler sells in Girard, Ohio, is mortality and major medical. Detwiler, an Agribusiness and Equine Specialist with Gibson Agri&Equine Insurance, explains that “every policy is required to have mortality coverage and then anything else that is added is added as an "additional" endorsement.”

So, she says, major medical, loss of use, surgical expense, extended renewal protection, accident, sickness and disease coverage, third party liability, and stallion infertility (among others) are all insurance options in addition to mortality coverage.

Mortality coverage generally covers any cause of death, including colic or fatal injuries. A horse’s age will limit his mortality insurance; many insurance companies can insure horses that are 24 hours old up to about 17 years old. Detwiler notes that 15 years old is about when it becomes more costly to insure the horse and when medical packages are restricted.

“A horse can be insured later in life; but, for every year the horse ages after 15, the rate debits making it more expensive,” She explains. “Often, veterinarian examinations are required each year for older horses as well.

Many factors are taken into account to determine a horse’s value; these can include age, sex, breed and discipline. A mortality policy can cover 100 percent of the horse’s value, but the premiums will be more expensive. While it can be very hard to objectively define what a horse is worth, it’s imperative to ensuring you have the adequate policy in place on your horse.

Major Medical

Major medical insurance covers a lot of medical and surgical treatments that may be cost prohibitive for owners. This coverage can include things like medications, diagnostic tools, surgery and care after surgery.

Major medical policies do not cover routine care like vaccines, teeth floating or sheath cleaning; many alternative treatments like acupuncture, chiropractic and massage are also not covered. Many policies also do not cover any cosmetic surgeries or surgeries on things that took place before the insurance policy took effect (think about things like birth defects).

Detwiler notes that a pre-existing condition could limit insurance coverage. “If a horse has a history of lameness in a specific leg or a history of colic, the company is typically going to exclude coverage for that condition The horse can still be insured for coverage for other conditions, but that specific condition would be excluded. For example: If a horse is diagnosed and treated for EPM in writing the policy, all claims related to EPM would not be covered. However, a colic claim or an unrelated injury or sickness could still be covered.”

“Insurance is designed to cover more ‘catastrophic’ accidents and injuries,” she says. “Though each company is different, there is always a deductible [around $300] for medical claims that are made. This helps to deter claims being made against routine procedures.”

Colic Insurance Programs

The American Association of Equine Practitioners estimates that 900,000 horses will colic in the United States each year. That number is staggering to think about! Gibson Agri&Equine Insurance is partnered with SmartPak to raise awareness of and education horse owners about colic. Detwiler explains that SmartPak has “a program in which if the horse is on SmartDigest Ultra [a SmartPak supplement] and is (strictly) following basic veterinary recommendations (up to date on shots, etc), SmartPak will cover up to $7,500 worth of veterinary expenses if the horse colics while on their supplement.”

But this is all the policy will cover, she expounds. “Their program ONLY covers expenses related to colic, whereas if you also have an equine policy with major medical coverage, any other kind of accident, injury or sickness or disease would be covered as well. And, if the expenses exceed what is paid by SmartPak the equine insurance would kick in if the horse colics.”

The Application

Be prepared to answer a lot of questions when it comes to insuring your equine. It will ask you everything from your name, address and phone number to details on where the horse is housed, who cares for him and what his intended use is. They will also ask his age, breed, sex and for a registration, tattoo or ID number. You will be asked to provide photos of your horse if it is not registered with an organization. You will also need to answer his date of birth and date of purchase. You will then be asked a series of question on the horse’s health and its history. These questions could include is he sound, has he colicked, has ever had joint injections or been nerved, does he have any conformational issues, and more.

Additional questions may include who the primary veterinarian is, is the horse co-owned, is he leased and is he covered by any other insurance.

So, Who Really Needs Equine Insurance?

“I would especially recommend equine insurnace for high-profile horses that were costly to purchase; this will protect the investment. And, these types of horses tend to be at greater risk as they are moving around--going to shows, races, in training, etc.. However, I would recommend it to any other horse owner as well. Even if the initial investment in the horse wasn't costly, the medical bills for any kind of accident or sickness can easily add up,” Detwiler says. “This is when it is beneficial to have the insurance to afford such expenses.”